| SYS |

|

|

The Financials tab allows you to define the classes and accounts used to group and track payments and refunds made within Projects, For example, when a payment is made for renting heavy machinery, it is classed under Operations and linked to a Heavy Machinery account.

Within Enquire, Work Breakdown Structure (WBS) is used to refer to a payment’s class (e.g. Operations) and General Ledger (Gl) Account is used to refer to the account (e.g. Heavy Machinery).

The Financials tab also allows you to setup funding categories used within Rounds and Projects to indicate how funds are allocated. Your organisation may allocate a certain amount of funding for a Round for infrastructure and administration costs. These categories can then be used to categorise a project’s budget or cost line items.

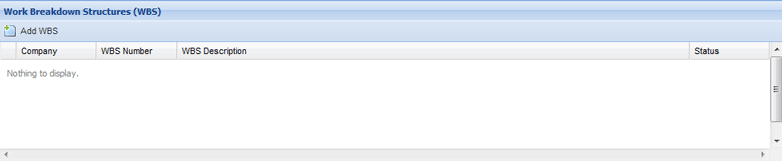

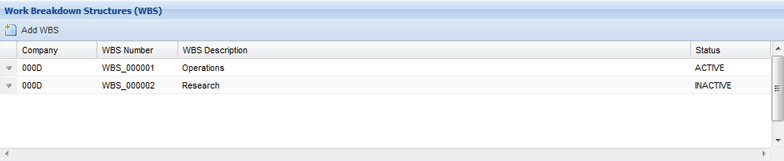

A Work Breakdown Structure is used as a way of grouping financials by class, cost centre, department or program. For example you may need to group payments and refunds under Operations, Land Care or Business Management Unit.

1. Select My Group from Home on the primary navigation and then select the Financials tab.

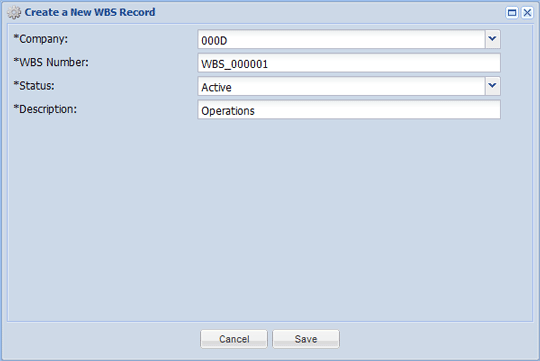

2. Select the Add WBS button.

3. Enter the mandatory WBS Record details:

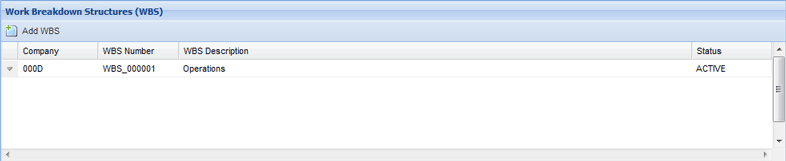

4. Select Save to create the WBS Record.

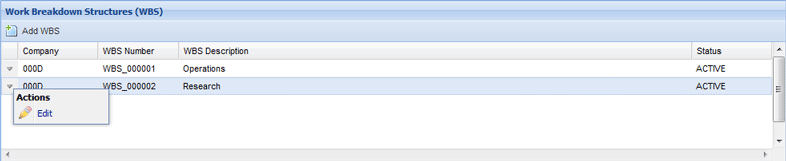

1. Select the down arrow next to the relevant WBS record.

2. Select Edit from the menu.

3. Make the relevant changes and then select Save to update the record.

Existing WBS can’t be deleted; they can only be made inactive. Inactivating a WBS prevents it from be selected within any Rounds and Payments created after the inactivation.

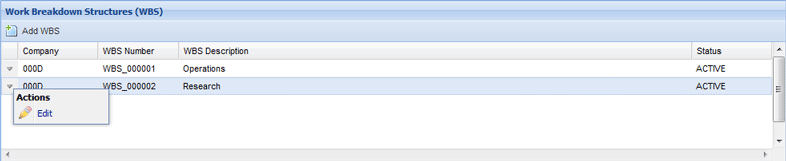

1. Select the down arrow next to the relevant WBS record.

2. Select Edit from the menu.

3. Select Inactive from the Status drop down menu.

The WBS record will now be inactive.

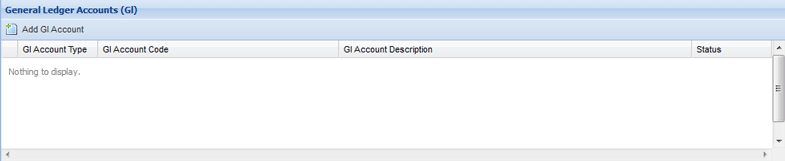

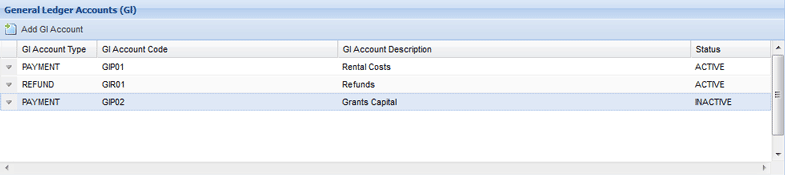

A General Ledger (Gl) Account is used to identify which account a payment or refund has been linked to. For example your organisation might link payments to the following accounts Travel, Heavy Machinery and Accounts Payable.

1. Select My Group from Home on the primary navigation and then select the Financials tab.

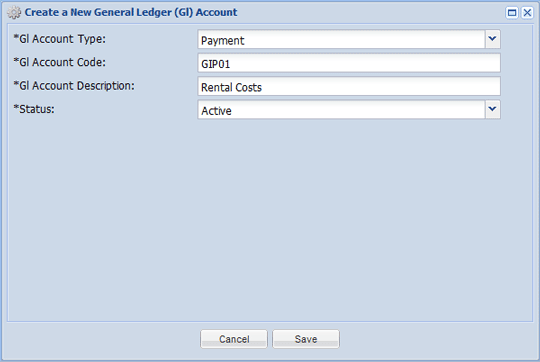

2. Select the Add GI Account button.

3. Enter the mandatory details:

4. Select Save to create the GI Account.

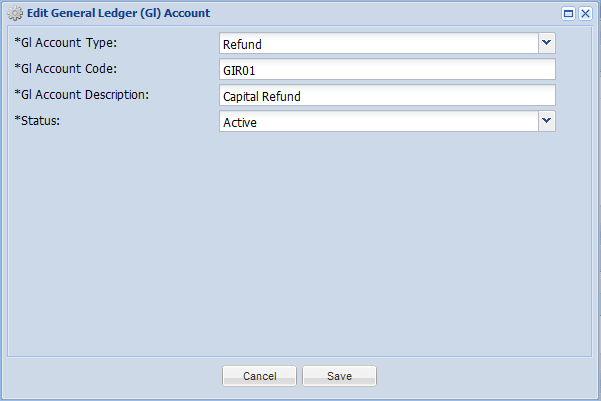

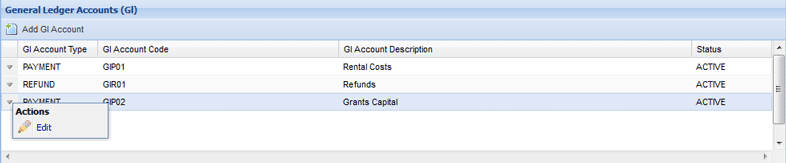

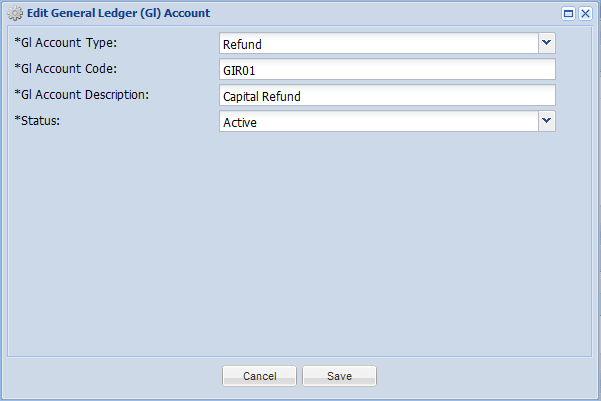

1. Select the down arrow next to the relevant GI Account.

2. Select Edit from the menu.

3. Make the relevant changes and select Save to retain them.

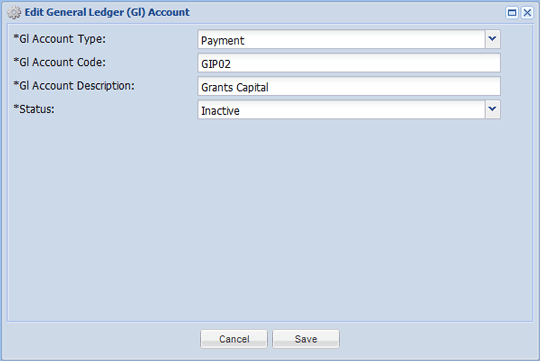

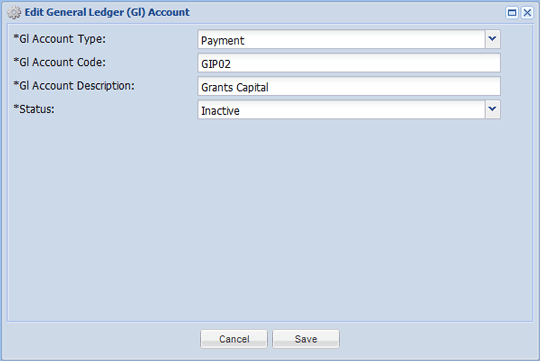

Existing Gl Accounts can’t be deleted; they will can only be made inactive. Inactivating a Gl Account prevents it from be selected within any Rounds and Payments created after the inactivation

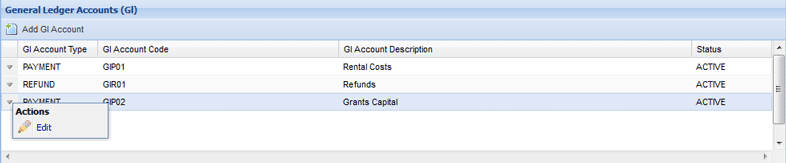

1. Select the down arrow next to the relevant Gl Account.

2. Select Edit from the menu.

3. Select Inactive from the Status drop down menu and select Save.

The Gl Account will now be inactive.

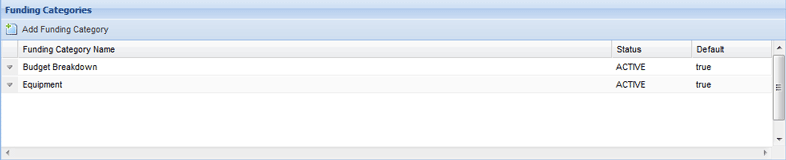

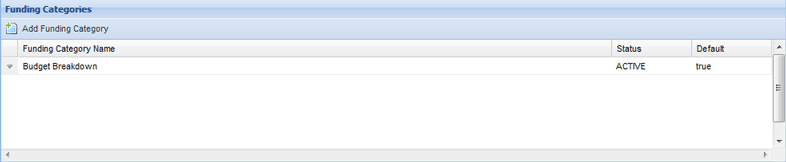

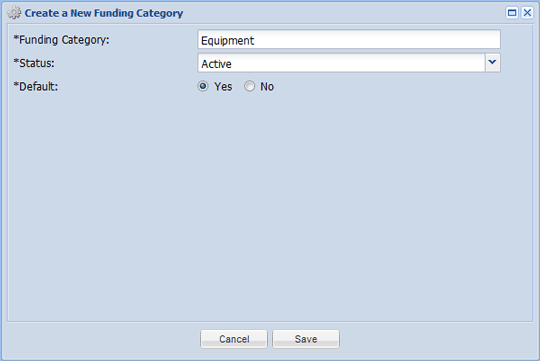

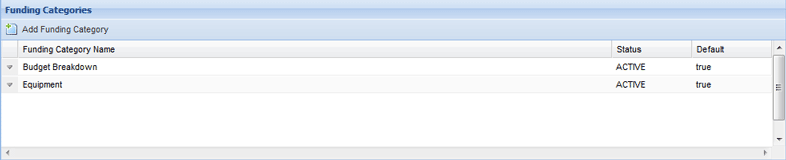

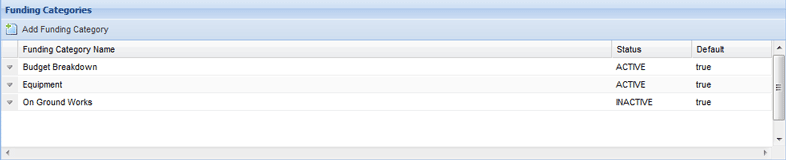

Funding Categories are used to indicate how much money is allocated (to a Round and Projects) between various categories such as Equipment, Infrastructure or Administration. Your organisation will have a default Budget Breakdown Funding Category set up.

1. Select My Group from Home on the primary navigation and then select the Financials tab.

2. Select the Add Funding Category button.

3. Enter the mandatory details:

4. Select Save to create the Funding Category.

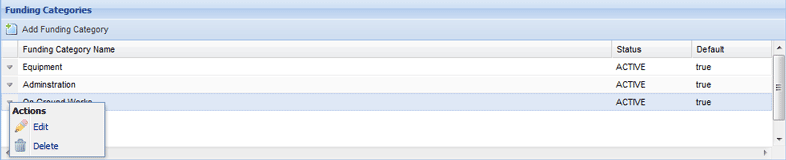

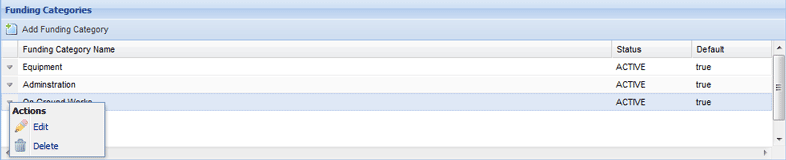

1. Select the down arrow next to the relevant Funding Category

2. Select Edit from the menu.

3. Make the relevant changes and then select Save to retain the changes.

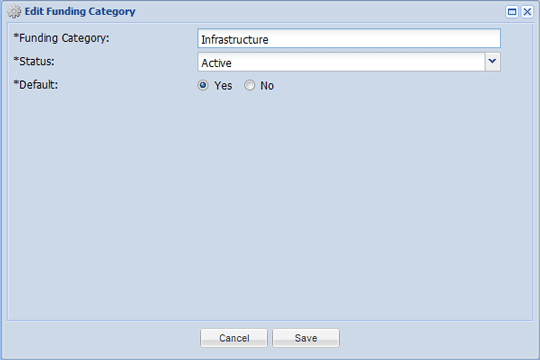

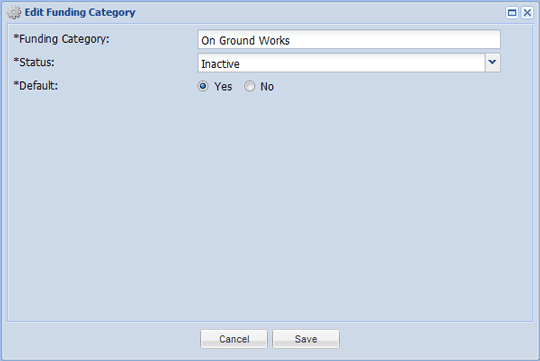

1. Select the down arrow next to the relevant Funding Category.

2. Select Edit from the menu.

3. Select Inactive from the Status drop down menu and then select Save.

The Funding Category will now be inactive.

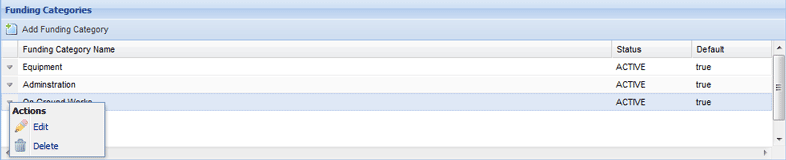

1. Select the down arrow next to the relevant Funding Category.

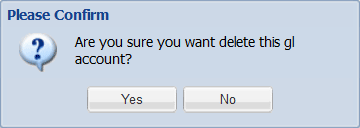

2. Select Delete from the menu.

3. Select Yes when prompted.

The Funding Category will now be deleted.